Friday, September 12, 2008

Thursday, September 11, 2008

Malaysia : 2009 May Be A Year of Uncertainty With A Bearish Bias

We have seen many things happen this year and records being broken in the financial markets like many records being broken in 2008 Olympics in China. The year 2008 would not be forgotten by many, especially those who are investing in the financial markets. It is one of the most volatile years in the financial markets since year 2000, or perhaps in history.

Let us review what happened this year and try to forecast what is likely going to happen next year. After all, forecasting is always based on historical information and forecasts are not 100% accurate all the time. However, it helps us to prepare expected challenges in the future. There is a very good Malay proverb for investors in the financial markets and that is “Sediakan payung sebelum hujan” and it means get an umbrella ready before the rain.

Average Weekly Range % (Volatility) of KLCI since 1994In Malaysia, the year started with a very bullish sentiment accumulated from a six years bullish trend that started in year 2002 after the dotcom bubble burst in the year 2000. The Kuala Lumpur Composite Index was at about 600 points. The momentum starts to get very bullish in the mid year 2006, when the KLCI was at about 900 points and one year later, it created a new record high. On April 2007, I wrote in Smart Investor and forecasted the KLCI to go as high as 1,500 points. In January 2008, the KLCI closed the highest level ever at 1,516.22 points.

Average Weekly Range % (Volatility) of KLCI since 1994In Malaysia, the year started with a very bullish sentiment accumulated from a six years bullish trend that started in year 2002 after the dotcom bubble burst in the year 2000. The Kuala Lumpur Composite Index was at about 600 points. The momentum starts to get very bullish in the mid year 2006, when the KLCI was at about 900 points and one year later, it created a new record high. On April 2007, I wrote in Smart Investor and forecasted the KLCI to go as high as 1,500 points. In January 2008, the KLCI closed the highest level ever at 1,516.22 points.While the equity markets were making new highs, a crisis was already brewing in the United States. During the year 2006-2007, nearly 1.3 million U.S. housing properties were subject to foreclosure activity, up 79% from 2006 because of interest rates has increased and prices of properties did not go up as expected. Prior to that, easy and low interest credit was available to people who are not credit-worthy. Therefore a sub-prime mortgage crisis began that eventually lead to bigger financial crisis.

Equity markets around the world soon realized the extent of damage sub-prime crisis can create and started to correct downwards in October 2007. Historical high closes were created on major indices around the world. The US Dow Jones Industrial Average was at 14,164 points, London’s FTSE was at 6,730 points, Hong Kong’s Hang Seng index was at 31,638 points and our close neighbor Singapore was at 3,875 points. These markets started to correct downwards after October 2007 but the Malaysian equity market continues to climb. Only property and construction companies were affected in 2007 from June onwards as the crisis at that time was only on properties.

The first quarter

In October the KLCI was at about 1,400 points and it climbed to its peak of 1,516 points in January 2008 and while other markets fell. This was primarily due to the increasing price of Malaysia’s major commodity, the crude palm oil. In early 2007, the price of crude palm oil was at about RM1,900 per metric ton and about 1 year later, it shot up more than double to a historical high of RM4,300 in March. Major plantation companies which are heavyweights in the KLCI enjoyed huge increases. In early 2007, SIME Berhad price was at RM7.00 and rose 85% to RM13.00 in January 2008. Another heavyweight IOI Corporation Berhad’s share price rose 140% from about RM3.50 to RM8.50.

In January 2008 after the KLCI made the historical high and which my earlier forecast target met, I made a forecast on Smart Investor (published in February 2008) that the KLCI is going to go into a major correction with a 1,100 target, after analyzing the current economic conditions and the price chart. The price of crude palm oil was trading at around RM3,500 per metric ton for about 4 months after correcting from the historical high in March. This has led to a decline in share prices of plantation companies.

UK’s leading financial house Northern Rock faced financial difficulties in 2007 and in February 2008, it was nationalized (being bought over by the government. Another financial giant was facing difficulties in the US. Bear Sterns was acquired by J.P. Morgan Chase and the government though the central bank has to provide a loan of US$29 billion for the deal to go through. It was uncertain times for Malaysians as they were going to a general election in March. It created another history in Malaysian politics when the ruling government failed to get 2/3 majority for the first time. The KLCI plunged further in face of uncertainty. All these happened in the first quarter of the year.

UK’s leading financial house Northern Rock faced financial difficulties in 2007 and in February 2008, it was nationalized (being bought over by the government. Another financial giant was facing difficulties in the US. Bear Sterns was acquired by J.P. Morgan Chase and the government though the central bank has to provide a loan of US$29 billion for the deal to go through. It was uncertain times for Malaysians as they were going to a general election in March. It created another history in Malaysian politics when the ruling government failed to get 2/3 majority for the first time. The KLCI plunged further in face of uncertainty. All these happened in the first quarter of the year.

The second quarter

In the second quarter of the year, the financial crisis deepens. The IMF warned that America's mortgage crisis has spiraled into "the largest financial shock since the Great Depression" and there is now a one-in-four chance of a full-blown global recession over the next twelve months. A report from Bloomberg on the 19th of May 2008 revealed that US$379 billion vanished in asset write-downs and credit losses since the beginning of 2007, including reserves set aside for bad loans, at more than 100 of the world's biggest banks and securities firms. The IMF added that world's financial firms could end up shouldering US$1 trillion worth of losses from the credit crunch.

The price of crude oil suddenly started to increase sharply in April. The price of crude oil rose 40% from US$100 per barrel in early April to a historical high of US$140 in June. Malaysians were in a shock when the government, for the first time in history increased consumer petrol price by 45% from RM1.92 per litre to RM2.70 per litre in June. The increase has caused price of consumer goods to increase and this eventually led to higher inflation. The KLCI was trading in a range of 1,200 points to 1,300 points in the second quarter.

Events in the second quarter fueled the already worsening crisis. With rising inflation and the pressure from governments to lower interest rates to support the financial system, it has created an economic problem. The pain from the deepening crisis is felt in the third quarter.

The third quarter

More government bailouts are happening in the west, and these bailouts caused tax payers money. Equity markets continue to decline from July to September and sentiments continue to be bearish and a new fear has arisen, recession. Most equity markets have already gone down by at least 40% in September since October 2007 peak.

Most of the major events happen in the last month of the third quarter, which is in September. Financial giant Merrill Lynch was acquired by Bank of America for $50 billion. Another financial giant, Lehman Brothers declared bankruptcy on 15 September 2008, facing a refusal by the federal government to bail it out. The US Federal Reserve provided an emergency loan of $85 billion to America’s largest insurance company AIG. Just over three weeks later the Fed reported that AIG had drawn down $70.3 billion of that $85 billion facility. These were only some of the highlights and I believe more financial institutions were facing serious problems. The financial catastrophe has not yet landed in Asia including Malaysia.

The recession fears and financial turmoil have caused price of commodities to fall. Price of light sweet crude oil fell to US$100 per barrel in September. Price of crude palm oil fell to RM2,100 per metric ton, more than half from the peak in March. The sharp decline in prices of commodities was not able to lower the prices of consumer goods and therefore, inflation remains high. Malaysia's inflation rate jumped to a 26-year high of 8.5 percent in August. It only managed to ease to 8.2% in September. The government decided to review price of fuel on a monthly basis and remove some subsidy. The KLCI was at 1,000 points in September 2008. The bearish sentiments have caused me to change my bearish forecast target from 1,100 points to 850 to 900 points.

Fourth quarter

Markets continue decline as more negative corporate earnings were reported and this time more aggressively. Many markets have suspended trading in this quarter because of a breach in the trading range limit. Some markets fell to its sharpest ever fall in a single day. The Dow Jones Industrial Average (DJI) made its biggest single day fall ever with 777.68 points or 7% in the end of September after the US$700 billion bailout plan by the US government failed to get support initially.

Further financial packages from governments and reduction in key interest rates have eased the aggressive decline and markets have found a bottom in late October. The US has cut its interest rates to near zero. The KLCI closed as low as 829.41 in October and is currently at 867.35 points, as at 7 November 2008.

Prices of commodities continue to decline heavily. Price of Crude Oil is currently trading at US$35 per barrel. Just 2 quarters ago, the price of crude oil was at US$140.

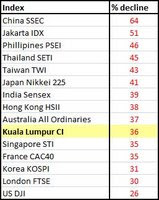

Most of the indices started to decline after October 2007 last year and if calculated from that peak, most of the indices have fallen more than 50%. Malaysia equity market generally fell about 36%.

Where do we go from here?

In my previous article in Smart Investor, I mentioned that the KLCI is heading for 850 to 900 range level for support. The KLCI has found a support at 800 points. Has the market bottomed out?In my humble opinion, temporarily yes, at least until the end of the year.

The equity market normally leads the economy by 8 to 12 months. The equity market has already fallen about 36% from the January high. The Malaysian economy is currently slowing down little, unlike other countries especially the west which is slowing rapidly. Our neighbour Singapore is already in a technical recession. Just recently, DBS Bank, a major bank in Singapore planned to cut its workforce by 6% or 900 jobs as profits declined sharply. Companies in Singapore are already preparing for an economic slowdown and economist are predicting that the worst is still far away from what is happening now. I'd expect Malaysia to cut interest rates in 2009 to spur the economy.

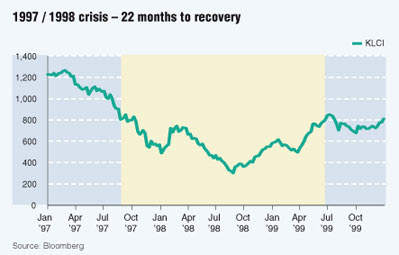

I expect the Malaysian economy into recession next year if the financial markets do not recover fast and when this happens, another sell down is expected in the equity market before the market finds its bottom. In 1997, the KLCI fell about 80% from the high of 1,300 points to a low of 260 points. Just a thought, if the current crisis is more severe than the Asian financial crisis, do you think it can fall more than 80% from the high of 1,500 points? My forecast is between 500 to 550 points.

The year 2009 may be a year of uncertainty with a bearish bias and the equity market volatility is expected to settle down a little from the 2008 tsunami. Investors should stay alert in 2009 as short term opportunities may still arise. Investors should learn how to identify these stocks fundamentally and technically. Investors should also look at other investment alternatives like the futures market, which allows investors to also profit from bear markets so that if the year 2009 remains bearish, the investment portfolio can still grow.

While others whine and complain on their disastrous investments in the past years, smart investors learn from their past investments and seek more knowledge to improve their investing skills. Investment education is the best investment when markets are uncertain and bearish. The experience and knowledge learned will prepare you as a better investor in the future.

Achmade Zachary Ghazali,

http://dca2u.blogspot.com

Wednesday, September 10, 2008

Industri Unit Amanah Bakal Alami Persaingan Sengit

KORPORAT

JOHOR BAHRU 25 Nov. - Industri unit amanah di negara ini bakal berdepan dengan persaingan yang sengit dalam menawarkan pulangan pelaburan yang menarik tahun depan.

Ketua Pegawai Eksekutif, ASM Investment Services Bhd. (ASM Investment), Nik Mohamed Zaki Nik Yusoff berkata, industri itu kini melalui 'tempoh sukar' terutamanya dengan penurunan pasaran saham yang mendadak ekoran krisis kewangan global.

Beliau berkata, syarikatnya tidak terkecuali menerima tempias kemelut itu apabila jualan bersih unit amanah sahamnya mengalami kemerosotan sebanyak 15 peratus sejak September lalu.

"Sejak Januari hingga Ogos lalu, jualan bersih unit amanah saham kami mencatatkan prestasi konsisten dengan jumlah melebihi RM30 juta setiap bulan.

"Justeru, jika hari ini kami menjangkakan pulangan pelaburan yang tinggi kepada pelabur pada tahun depan, pasti ramai yang memandang sinis kepada kami.

"Namun ASM Investment tetap komited untuk mampu sekurang-kurangnya mencapai pulangan pelaburan yang sama seperti yang diumumkan pada tahun ini," katanya.

Beliau berkata demikian pada sidang akhbar selepas merasmikan Pejabat Wilayah Johor di sini hari ini. Turut hadir, Timbalan Pengurus Besar, Pembangunan Perniagaan, ASM Investment, Chong Teik Siang dan Pengurus Wilayah Johor, Norsyah Nizam A. Aziz.

Nik Mohamed Zaki berkata, pelabur sebenarnya perlu merebut peluang daripada penurunan pasaran saham ketika ini untuk membeli stok saham yang berkualiti pada harga yang rendah. Jelasnya, sejarah membuktikan pasaran saham akan berubah mengikut kitaran ekonomi untuk kembali pulih dan pada waktu itu, pelabur boleh mengaut keuntungan daripada pelaburan yang dilakukan pada masa sekarang.

"Dalam setiap krisis kewangan, pelabur tidak menyedari bahawa wujud peluang untuk membuat pelaburan. Kegawatan ekonomi 1998 menyebabkan Indeks Komposit Kuala Lumpur (IKKL) merudum hingga paras rendah sekitar 260 mata.

"Krisis kewangan global ketika ini pula hanya menyebabkan IKKL mengalami penurunan pada paras 850 mata. Tetapi ekonomi akan melalui satu pusingan dan bagi pengurus dana, senario ini merupakan satu peluang baik untuk membeli stok saham yang berkualiti pada harga rendah.

"Pasaran saham bergantung kepada sentimen pelabur yang sering didorong dengan pelbagai spekulasi. Mengikut sejarah, pelaburan di pasaran saham perlu dilakukan untuk tempoh jangka panjang. Walaupun berlaku penurunan, pada dasarnya ia akan naik kembali selepas tempoh lima tahun," katanya.

Dalam perkembangan lain, Nik Mohamed Zaki berkata, ASM Investment kini mengorak langkah setapak lagi dalam industri itu apabila menawarkan unit amanah dalam talian sejak dua bulan lalu.

Katanya, tawaran yang dilakukan melalui pihak ketiga itu mampu menjadikan pendekatan dalam taliannya diterima baik oleh pelabur dan industri unit amanah di negara ini dalam jangka masa panjang.

Beliau juga berkata, ASM Invesntment bercadang untuk membuka dua lagi pejabat wilayah di Kuantan, Pahang dan Seberang Jaya, Pulau Pinang pada bulan depan.

Selain Johor katanya, syarikat itu juga telah membuka dua pejabat wilayahnya pada tahun ini di Kuching, Sarawak dan Kota Kinabalu, Sabah bermula Januari dan Mei lalu.

ASM Investment kini menguruskan sebanyak 17 dana dan memiliki saiz dana yang diuruskan sebanyak RM500 juta.

Source : Utusan Online, ov 26, 2008

Achmade Zachary Ghazali,

http://dca2u.blogspot.com

JOHOR BAHRU 25 Nov. - Industri unit amanah di negara ini bakal berdepan dengan persaingan yang sengit dalam menawarkan pulangan pelaburan yang menarik tahun depan.

Ketua Pegawai Eksekutif, ASM Investment Services Bhd. (ASM Investment), Nik Mohamed Zaki Nik Yusoff berkata, industri itu kini melalui 'tempoh sukar' terutamanya dengan penurunan pasaran saham yang mendadak ekoran krisis kewangan global.

Beliau berkata, syarikatnya tidak terkecuali menerima tempias kemelut itu apabila jualan bersih unit amanah sahamnya mengalami kemerosotan sebanyak 15 peratus sejak September lalu.

"Sejak Januari hingga Ogos lalu, jualan bersih unit amanah saham kami mencatatkan prestasi konsisten dengan jumlah melebihi RM30 juta setiap bulan.

"Justeru, jika hari ini kami menjangkakan pulangan pelaburan yang tinggi kepada pelabur pada tahun depan, pasti ramai yang memandang sinis kepada kami.

"Namun ASM Investment tetap komited untuk mampu sekurang-kurangnya mencapai pulangan pelaburan yang sama seperti yang diumumkan pada tahun ini," katanya.

Beliau berkata demikian pada sidang akhbar selepas merasmikan Pejabat Wilayah Johor di sini hari ini. Turut hadir, Timbalan Pengurus Besar, Pembangunan Perniagaan, ASM Investment, Chong Teik Siang dan Pengurus Wilayah Johor, Norsyah Nizam A. Aziz.

Nik Mohamed Zaki berkata, pelabur sebenarnya perlu merebut peluang daripada penurunan pasaran saham ketika ini untuk membeli stok saham yang berkualiti pada harga yang rendah. Jelasnya, sejarah membuktikan pasaran saham akan berubah mengikut kitaran ekonomi untuk kembali pulih dan pada waktu itu, pelabur boleh mengaut keuntungan daripada pelaburan yang dilakukan pada masa sekarang.

"Dalam setiap krisis kewangan, pelabur tidak menyedari bahawa wujud peluang untuk membuat pelaburan. Kegawatan ekonomi 1998 menyebabkan Indeks Komposit Kuala Lumpur (IKKL) merudum hingga paras rendah sekitar 260 mata.

"Krisis kewangan global ketika ini pula hanya menyebabkan IKKL mengalami penurunan pada paras 850 mata. Tetapi ekonomi akan melalui satu pusingan dan bagi pengurus dana, senario ini merupakan satu peluang baik untuk membeli stok saham yang berkualiti pada harga rendah.

"Pasaran saham bergantung kepada sentimen pelabur yang sering didorong dengan pelbagai spekulasi. Mengikut sejarah, pelaburan di pasaran saham perlu dilakukan untuk tempoh jangka panjang. Walaupun berlaku penurunan, pada dasarnya ia akan naik kembali selepas tempoh lima tahun," katanya.

Dalam perkembangan lain, Nik Mohamed Zaki berkata, ASM Investment kini mengorak langkah setapak lagi dalam industri itu apabila menawarkan unit amanah dalam talian sejak dua bulan lalu.

Katanya, tawaran yang dilakukan melalui pihak ketiga itu mampu menjadikan pendekatan dalam taliannya diterima baik oleh pelabur dan industri unit amanah di negara ini dalam jangka masa panjang.

Beliau juga berkata, ASM Invesntment bercadang untuk membuka dua lagi pejabat wilayah di Kuantan, Pahang dan Seberang Jaya, Pulau Pinang pada bulan depan.

Selain Johor katanya, syarikat itu juga telah membuka dua pejabat wilayahnya pada tahun ini di Kuching, Sarawak dan Kota Kinabalu, Sabah bermula Januari dan Mei lalu.

ASM Investment kini menguruskan sebanyak 17 dana dan memiliki saiz dana yang diuruskan sebanyak RM500 juta.

Source : Utusan Online, ov 26, 2008

Achmade Zachary Ghazali,

http://dca2u.blogspot.com

Tuesday, September 9, 2008

24-12-2008: OSK investment strategy 2009

A special report by OSK Research

2008 –

A year to forget FROM record highs to multi-year lows. 2008 was indeed a roller-coaster year for the KLCI with a record high of 1,524.69 pts on Jan 14 before plunging to a four-year low of 801.27 on Oct 28.

Caution was already in the air at the start of the year as the valuations of certain companies started to look stretched although the market PER as a whole was still reasonable at 16 times to 17 times.

As the global financial turmoil worsened, the deleveraging by hedge funds which had been caught flat-footed led to capital flight from emerging markets back to the US. This in turn bolstered the US dollar, which strengthened from a low of RM3.13 to a high of RM3.63 on Nov 20.

The stronger US dollar consequently brought about a weakening in commodity prices. Crude oil touched a peak of US$147.27 (RM515.45) per barrel in July and then plummeted by some 60% while crude palm oil (CPO), which hit a high of RM4,206 per tonne in March, lost 70% up to October.

When commodity prices slid, so did commodity-related sectors such as plantation, oil and gas (O&G) and steel. While the plantation sector constituted some 21% of the KLCI's weighting in January, this had fallen to 15% by October given the dip in plantation stocks.

A busy year for news. Undoubtedly, the biggest news in 2008 was the outcome of the March 8 general election. With the ruling Barisan Nasional returned to power on only a simple majority and five states falling into the opposition's hands, the market had reacted negatively, plummeting 123 points in its largest single-day drop in 2008. Other key events that sparked strong reactions in the market were:

A busy year for news. Undoubtedly, the biggest news in 2008 was the outcome of the March 8 general election. With the ruling Barisan Nasional returned to power on only a simple majority and five states falling into the opposition's hands, the market had reacted negatively, plummeting 123 points in its largest single-day drop in 2008. Other key events that sparked strong reactions in the market were:

*Jan 16 and Jan 22: A drop of 52 points and 54 points on fears of a global recession

*Jan 16 and Jan 22: A drop of 52 points and 54 points on fears of a global recession *June 5: A 30-point drop after the government imposed a windfall tax on independent power producers

*Aug 29: A pre-Merdeka rally - As far as news flow was concerned, 2008 was not short on major developments that included:

- Bank transactions: EPF's sale of a 25% stake in RHB to the Abu Dhabi Commercial Bank, Maybank's acquisitions of Pakistan's MCB Bank and Indonesia's BII, Bumi-Commerce's acquisition of a stake in BankThai

- O&G developments: KNM's RM1.7 billion purchase of Germany's Borsig, MISC's cancellation of its proposed RM3.2 billion RTO of Ramunia and Dialog as well as Wah Seong securing contracts for the Sabah-Sarawak Gas Pipeline

- Major corporate restructuring: Telekom was split into TM and TMI, MMC proposed a major related-party transaction involving Senai Airport and UEM World's major restructuring exercise.

Defensive nature returns. In line with previous years, the defensive nature of the Malaysian market returned to the fore as the KLCI outperformed all its major regional peers. Even as political turmoil gripped the local market, news flow from the region was equally poor with political unrest in Thailand, recession in Singapore, natural disasters and a massive food scare in China and political uncertainty in Korea. Markets in East Asia performed even worse than the US largely due to deleveraging by US-based funds.

Defensive nature returns. In line with previous years, the defensive nature of the Malaysian market returned to the fore as the KLCI outperformed all its major regional peers. Even as political turmoil gripped the local market, news flow from the region was equally poor with political unrest in Thailand, recession in Singapore, natural disasters and a massive food scare in China and political uncertainty in Korea. Markets in East Asia performed even worse than the US largely due to deleveraging by US-based funds.

Relief rally peters out. At the time of writing, as we had been predicting since 3Q, the KLCI had indeed staged a relief rally, taking it off its low of 800 points towards the 900 level. However, this rally petered out in the second week of November and selling pressure re-emerged across the region with the ringgit hitting new lows against the US dollar.

1H09 – Not a pretty picture

Financial turmoil leads to global slowdown.While the latter part of 2008 was dominated by news of bank failures in Europe and the US as well as a crisis of con?dence, this is giving way to the reality that the global economy faces a sharp slowdown, if not a recession. While the interest rate cuts by various governments worldwide should help ease the pain, the slowdown in consumer spending is certain to take its toll on economic growth, particularly in 1H09.

Malaysia will not be spared. While our house forecast for gross domestic product (GDP) growth may appear relatively optimistic at 2.7%, this must be viewed in light of past growth rates of 5.9% in 2006, 6.3% in 2007 and 5.3% in 2008.

The fall in commodity prices, especially oil and CPO, will take its toll on government and corporate revenue. As the global drop in consumer con?dence and spending will reduce demand for Malaysia's electronic exports, we will also see domestic consumption shrinking sharply in 1H09. All in all, 1H09 will not be an easy time for corporate Malaysia.

Spending patterns will change. As the economy slows down, we see the rakyat being squeezed by lower disposable income. While the issue for most of 2008 was high inflation brought about by high petrol prices and electricity tariff adjustments, the concern for 2009 appears to be of reduced income.

From SMEs that would have to cut back on exports and production to the man-in-the-street who faces possible retrenchment, there seems to be very little reprieve for the domestic consumer, who has yet to recover from the high price pressures in mid-2008.

For 2009, spending patterns would definitely shift with non-essential items likely to drop out of most consumers' shopping list. We see Malaysian urban spending shift closer to rural spending patterns with reduced spending on recreation, restaurants, hotels and miscellaneous items.

Not cheap on a regional basis. Looking at the stock market, the pessimistic view on the economy is reinforced by Malaysia's standing as an outperformer during the recent selldown that has rendered it a relatively expensive market compared with its peers.

As it currently stands, Malaysia is the third most expensive market in Asia behind only China and Japan. Our saving grace is the relatively high dividend yield, which reinforces the view of Malaysia as a defensive market.

4QFY08 results season likely to be ugly. While we are hopeful that the 3QFY08 results will be relatively benign given that commodity prices had remained largely firm during the quarter, the collapse in commodity prices and the subsequent global slowdown should hit 4Q numbers rather hard.

With the 4Q results reporting season falling in February 2009, we expect the KLCI to hit a nadir around this period. We see a correlation between the results being announced and the performance of the local market.

Our expectation for a benign 3Q fits in with our view of a 2008 year-end flattish performance for the KLCI but expectation of a weak 4Q results season ties in with our view of a poor 1H09.

2H09 – Hoping for a recovery

Things may turn better in 2H09. Given our expectation that the stock market tends to trade ahead of the economy by six months, we expect a recovery in the KLCI in 2H09 as we believe an economic recovery may come about beginning end-2009. For 2009, we see external factors playing a more crucial role than domestic factors.

We see East Asian economies, especially China, as the key to economic recovery while the US government's rescue plans may also take effect later in 2009. On the domestic front, political uncertainties are expected to ease after the Umno election in March 2009 when the deputy president's position will be determined.

We see East Asian economies, especially China, as the key to economic recovery while the US government's rescue plans may also take effect later in 2009. On the domestic front, political uncertainties are expected to ease after the Umno election in March 2009 when the deputy president's position will be determined.

East Asian economies lead the way. While the recent turn of events have proven that the theory of economic decoupling remains a theory, East Asian economies are nonetheless in a much stronger position to assist in the global recovery. China's foreign reserves exceeding US$1.9 trillion far outweigh those held by any other developed economy, perhaps with the exception of Japan's more than US$900 billion.

While its trade surplus should narrow somewhat given its dependence on exports, we believe an aggressive monetary policy by the Chinese government could see it slashing interest rates significantly to prop up domestic spending.

While a double-digit growth rate will likely be out of reach in 2009, most estimates still point to GDP growth of 7% to 8% for China. China still had the capacity for growth during the 2000/2001 tech-bubble recession in the US. China is not a country to shrink from aggressive interest rate cuts, as evident in 1997/1998 and 2000/2001. From a high of 7.47% in 1H08, China has cut its interest rates to 5.58% and we believe it could well be slashed further to 5.3%, which was the low in 2002.

The Chinese government has also indicated that it is not averse to aggressive stimulus packages, having unveiled its own package valued at US$586 billion (RM2.05 trillion) through 2010, a sum equivalent to some 18% of its US$3.3 trillion annual GDP compared to the US' US$700 billion package, which amounts to only some 5% of its annual GDP.

US not going the way of Japan. The current turmoil in the US has been compared with Japan's situation in the early 1990s. While both recessions appear to have been triggered by easy liquidity that led to an asset bubble that eventually burst, the reaction of the US government appears to have been much quicker than the path taken by Japan in the 1990s.

While housing prices in the US fell before the stock market, giving the US Fed more leeway to cut interest rates much faster and more aggressively, it was the other way round in Japan, with the stock market falling before asset prices, leading to the government keeping its interest rates high even as markets tumbled.

The Japanese government was also less aggressive in disbursing stimulus packages that could have spurred a recovery in its economy while the US has already given a US$150 billion tax rebate, US$700 billion in the Troubled Assets Relief Program (TARP) and is now considering another stimulus package. As such, combined with China's ability to spur domestic consumption via interest rate cuts and other stimulus packages, we believe the global economy will recover towards end-2009.

The Japanese government was also less aggressive in disbursing stimulus packages that could have spurred a recovery in its economy while the US has already given a US$150 billion tax rebate, US$700 billion in the Troubled Assets Relief Program (TARP) and is now considering another stimulus package. As such, combined with China's ability to spur domestic consumption via interest rate cuts and other stimulus packages, we believe the global economy will recover towards end-2009.

While housing prices in the US fell before the stock market, giving the US Fed more leeway to cut interest rates much faster and more aggressively, it was the other way round in Japan, with the stock market falling before asset prices, leading to the government keeping its interest rates high even as markets tumbled.

The Japanese government was also less aggressive in disbursing stimulus packages that could have spurred a recovery in its economy while the US has already given a US$150 billion tax rebate, US$700 billion in the Troubled Assets Relief Program (TARP) and is now considering another stimulus package. As such, combined with China's ability to spur domestic consumption via interest rate cuts and other stimulus packages, we believe the global economy will recover towards end-2009.

The Japanese government was also less aggressive in disbursing stimulus packages that could have spurred a recovery in its economy while the US has already given a US$150 billion tax rebate, US$700 billion in the Troubled Assets Relief Program (TARP) and is now considering another stimulus package. As such, combined with China's ability to spur domestic consumption via interest rate cuts and other stimulus packages, we believe the global economy will recover towards end-2009. Commodity prices to stabilise. While we had earlier hoped to avoid a global recession and the corresponding collapse in commodity prices, the reality now is quite different, with the World Bank having cut its GDP growth forecast to 1% for 2009 - a recession in all but number.

This, coupled with a reversal in speculation sentiment, drove down commodity prices across the board with CPO and crude oil taking a bashing, albeit at a different pace. For 2009, we see commodity prices gradually stabilising despite the forecast drop in demand.

This, coupled with a reversal in speculation sentiment, drove down commodity prices across the board with CPO and crude oil taking a bashing, albeit at a different pace. For 2009, we see commodity prices gradually stabilising despite the forecast drop in demand.

With the Organisation of Petroleum Exporting Countries (Opec) having cut supply by 1.5 million barrels per day (bpd) since early September, it is expected to announce another cut of one million bpd by end-November, with a possibility of more cuts in December if oil prices do not stabilise. Some Opec countries have indicated that a price range of US$70 to US$90 per barrel is an acceptable range. Consistent with our house view of a weakening US dollar after global deleveraging ends, commodity prices should recover in 2009.

Since early 2007, oil prices have been showing a strong negative correlation to the US dollar, as indicated by the Dollar Trade Weighted Index. With a slew of Treasury bills to be issued to fund the US$700 billion bailout plan and further interest rate cuts in the pipeline by the US Federal Reserve, we see a weakening in the US dollar and strengthening oil prices in the coming months.

As for CPO prices, we see a decoupling from oil prices given CPO's far steeper fall in the last few months. With soybean prices at breakeven level, the planting of soybean will ease, which should help support vegetable oil prices. The mandatory use of biodiesel in Indonesia should help reduce the inventory of CPO while the cutback in the use of fertilisers will eventually have an impact on production come 2010.

As for CPO prices, we see a decoupling from oil prices given CPO's far steeper fall in the last few months. With soybean prices at breakeven level, the planting of soybean will ease, which should help support vegetable oil prices. The mandatory use of biodiesel in Indonesia should help reduce the inventory of CPO while the cutback in the use of fertilisers will eventually have an impact on production come 2010.

Our house view on commodity prices is for oil to average at US$60 to US$70 per barrel in 2009 while our average CPO price assumption is RM1,650 per tonne. Given that plantation counters still account for some 15% of the KLCI's weighting, stable CPO prices should allow the KLCI to arrest any further selling pressure.

Malaysia - no repeat of 1998. On the domestic front, Malaysia is in a much better position than it was in 1998 or even 2001. With our foreign reserves having grown four-fold since 1998 and three-fold since 2001, we are in a better liquidity position than we were 10 years ago.

Our non-performing loans level has also fallen significantly from 13.6% in 1998 to 2.4% currently while our loans to deposit ratio is also much healthier at 74.3% compared with 92% in 1998. As such, our banks are not at risk of major defaults and we feel that the entire financial system is much healthier than it was 10 years ago.

Our non-performing loans level has also fallen significantly from 13.6% in 1998 to 2.4% currently while our loans to deposit ratio is also much healthier at 74.3% compared with 92% in 1998. As such, our banks are not at risk of major defaults and we feel that the entire financial system is much healthier than it was 10 years ago.

We are still looking at a 4% loans growth for 2009.

Inflation easing. While the concern starting from 2Q08 was of stagflation as inflation rates in Malaysia hit a high of 8.5%, we believe this will ease significantly in the coming months. The government has already implemented several petrol price cuts to bring the pump price down from RM2.70 per litre for RON97 to RM1.80 per litre.

Inflation easing. While the concern starting from 2Q08 was of stagflation as inflation rates in Malaysia hit a high of 8.5%, we believe this will ease significantly in the coming months. The government has already implemented several petrol price cuts to bring the pump price down from RM2.70 per litre for RON97 to RM1.80 per litre.

The drop in international coal prices is also giving Tenaga Nasional (TNB) less ammunition to argue for an electricity tariff hike in 2009. In fact, the Energy Minister has stated that if coal prices fall consistently to below US$75 per tonne, there should be a tariff cut. Given the government's move to pressure food outlets and hypermarkets to cut prices, we see inflationary pressures easing significantly by 2H09 for an average Consumer Price Index (CPI) growth of 3.4% in 2009 versus 5.8% in 2008. As such, there may be a pick-up in domestic consumption towards the end of 2009.

Malaysians have short memory. Assuming that history repeats itself and a generation spans 20 years, we take a look at the previous bear markets in 1987/88, 1997/98 and 2000/01 and note that the market took an average 18 to 22 months to recover to a reasonable level. In 1987/88, it was 18 months before the market recovered between October ‘87 and March '89. In 1997/98, the bear market stretched some 22 months from August '97 to June '99 while for 2000/01, the bear market lasted 20 months, from June 2000 to February '02. If we take the current bear market as having started from March '08, we see the market recovering by 3Q or 4Q09.

But watch out for banana skins

Politics

Aside from the risk of the global economy taking longer to recover or developing countries being dragged into a recession, we feel that the greatest risk to a recovering market in 2H09 will be politics. While the credibility of the opposition claim of taking over the federal government had somewhat taken a dent since the September 2008 deadline came and went, we do not write it off completely.

Given that foreign direct investment (FDI) is unlikely to return significantly in 2009, any change of government can only lead to greater instability for the nation at this time. At the same time, the long- drawn-out campaign period for the Umno general assembly up to March 2009 could see the domestic political scene continue to remain unstable for some months yet. As such, we only see a market recovery after March '09 when the issue is hopefully resolved.

Corridors may not help

While the growth corridors were generally launched with much fanfare in 2007, the news flow for many of the corridors has slowed down considerably. While we were never too optimistic on the impact of the corridors on the stock market to begin with, the cancellation or postponement of any of the corridors, especially after the political landscape changes in March '09, could create more jitters among foreign investors.

Forecasting a flat KLCI target of 1,020. 2009 target: 1,020 points. With our house estimates of a 4% loans growth, crude oil at US$60 to US$70 per barrel and CPO at RM1,650 per tonne, and the country's still positive GDP growth, we see corporate earnings growing by some 1.8% in 2009.

We derive our 2009 year-end target of 1,020 points after applying a 12 times PER to the KLCI. Over the past 10 years, the KLCI has traded in a wide range with the lows of eight to nine times during the 97/98 financial crisis. Since 2000, the KLCI has traded within a tighter PER range of nine to 30 times with the market reaching a trough in the latter months of 2008. With the market average PER at 16 times, we see a 12 times target PER - which is more than one standard deviation from the mean - as being reasonable as market confidence slowly returns across the globe.

Not a pipe dream

With an upside of some 170 points to our 2009 target, we wish to clarify that this is no pipe dream. Based on the fair value on our buy calls among the top 15 KLCI constituents which make up some 36.8% of the KLCI, achieving our fair values would see the KLCI rise about 89 points. As such, achieving the 1,020-point-year-end target should not be too far out of reach.

The sectors we like. Based on our house view of a depressed 1H09 followed by a potential recovery in 2H, the sectors that we are still overweight on are generally the defensive ones. We remain overweight on only five sectors namely gaming, consumer - food, rubber gloves, steel and utilities.

Investment strategy for 2009

Again, based on our market outlook for 2009, we drew up a three-pronged strategy designed to satisfy a broad range of investors:

i) For those with lower risk appetite and who are less keen to try and time the market, we have a list of defensive stocks that should ride out the coming economic storm relatively unscathed

ii) For those with a higher risk appetite who believe that the market may recover in 2H, we list out a few value stocks that should provide higher returns when the KLCI rebounds.

iii) For those looking to benefit from the downturn, we have also identified a number of downtrading stocks although many of these are not under our regular coverage.

Out of this basket of stocks, we have distilled our top five big-cap picks and top five small-cap picks.

Out of this basket of stocks, we have distilled our top five big-cap picks and top five small-cap picks.

Source : theedgedaily.com

Achmade Zachary Ghazali,

http://dca2u.blogspot.com

Apec Leaders Confident Global Economy Will Begin To Recover In 18 Months

Business

LIMA (Peru) Nov 24 (Bernama) -- Asia-Pacific Economic Cooperation (Apec)leaders wrapped up their annual summit here expressing confidence that they can overcome the crippling global economic crisis in 18 months' time.

"The general consensus is that 2009 will be a difficult year for the global economy but in 2010, we expect some early signs of recovery and hopefully it will be back on track then," Deputy Prime Minister Datuk Seri Najib Tun Razak, said Sunday.

"It is comforting that Apec leaders have shown positive leadership in overcoming the current global financial crisis by committing to free and open trade and to complete the Doha Round of global trade talks by December," he told Malaysian journalists at the end of the two-day summit.

Najib joined world leaders on the final day of discussions at the Ministry of Defence following which Peruvian President Alan Garcia read out the Lima Declaration including a separate statement on the global economy.

As Garcia spoke, many economies were reeling from by the crisis with several major economies already slipping into recession.

His maiden participation at Apec, Najib also joined leaders to don a brown poncho, which is the customary fashion among leaders to put on an attire of the host country.

He said leaders were also confident of recovery as members put in more efforts towards greater regional integration besides resolving to coordinate efforts in embarking on stimulus packages.

Efforts to strengthen the global financial system, especially the banking system, plus positive indications of a global initiative to work closely in a coordinated fashion augur well for recovery, he said.

Elaborating on Apec's efforts to strengthen regional economic integration (REI), Najib, who is also Finance Minister, said Malaysia supported the proposed Free Trade Area of the Asia-Pacific (FTAAP) premised on the principle of deeper REI.

There were some countries which wanted it to be done fast while others were not. Najib emphasised that it was not a binding arrangement but voluntary which means each country could have its respective views on the proposal.

However, "our reservation is that it should be undertaken on a step-by-step approach because if we move it too fast, it could exacerbate the imbalance among countries in the region and the initiatives currently undertaken by Asean such as negotiating free trade agreements might be diluted.

"There should be a comprehensive study first to indicate the real benefits from the FTAAP before we can get all countries to move in that direction," said Najib.

"We are not against it, its is just a question of timing and moving at a pace we are comfortable with, so as to ensure maximum benefits for all countries in the future," he said.

Apec leaders said in the communique entitled "A New Commitment to Asia-Pacific Development" that there would be challenges in the creation of an FTAAP although there would likely be economic benefits to the region as a whole.

"We have instructed ministers and officials to conduct further analytical work on the likely economic impact of an FTAAP," the leaders said.

Next years summit will be hosted by Singapore.

-- BERNAMA

Source : Bernama, Nov 24, 2008

Achmade Zachary Ghazali,

http://dca2u.blogspot.com

LIMA (Peru) Nov 24 (Bernama) -- Asia-Pacific Economic Cooperation (Apec)leaders wrapped up their annual summit here expressing confidence that they can overcome the crippling global economic crisis in 18 months' time.

"The general consensus is that 2009 will be a difficult year for the global economy but in 2010, we expect some early signs of recovery and hopefully it will be back on track then," Deputy Prime Minister Datuk Seri Najib Tun Razak, said Sunday.

"It is comforting that Apec leaders have shown positive leadership in overcoming the current global financial crisis by committing to free and open trade and to complete the Doha Round of global trade talks by December," he told Malaysian journalists at the end of the two-day summit.

Najib joined world leaders on the final day of discussions at the Ministry of Defence following which Peruvian President Alan Garcia read out the Lima Declaration including a separate statement on the global economy.

As Garcia spoke, many economies were reeling from by the crisis with several major economies already slipping into recession.

His maiden participation at Apec, Najib also joined leaders to don a brown poncho, which is the customary fashion among leaders to put on an attire of the host country.

He said leaders were also confident of recovery as members put in more efforts towards greater regional integration besides resolving to coordinate efforts in embarking on stimulus packages.

Efforts to strengthen the global financial system, especially the banking system, plus positive indications of a global initiative to work closely in a coordinated fashion augur well for recovery, he said.

Elaborating on Apec's efforts to strengthen regional economic integration (REI), Najib, who is also Finance Minister, said Malaysia supported the proposed Free Trade Area of the Asia-Pacific (FTAAP) premised on the principle of deeper REI.

There were some countries which wanted it to be done fast while others were not. Najib emphasised that it was not a binding arrangement but voluntary which means each country could have its respective views on the proposal.

However, "our reservation is that it should be undertaken on a step-by-step approach because if we move it too fast, it could exacerbate the imbalance among countries in the region and the initiatives currently undertaken by Asean such as negotiating free trade agreements might be diluted.

"There should be a comprehensive study first to indicate the real benefits from the FTAAP before we can get all countries to move in that direction," said Najib.

"We are not against it, its is just a question of timing and moving at a pace we are comfortable with, so as to ensure maximum benefits for all countries in the future," he said.

Apec leaders said in the communique entitled "A New Commitment to Asia-Pacific Development" that there would be challenges in the creation of an FTAAP although there would likely be economic benefits to the region as a whole.

"We have instructed ministers and officials to conduct further analytical work on the likely economic impact of an FTAAP," the leaders said.

Next years summit will be hosted by Singapore.

-- BERNAMA

Source : Bernama, Nov 24, 2008

Achmade Zachary Ghazali,

http://dca2u.blogspot.com

Zeti: Malaysia Will Not Slip into Recession

Sturdy domestic demand and Govt policies to help expand economy

KUALA LUMPUR: As global economic growth weakens significantly, Bank Negara believes Malaysia will not join the list of countries that have slipped into recession.

Governor Tan Sri Dr Zeti Akhtar Aziz said the country’s sturdy domestic demand, which has driven the key services sector, along with policies already in place, would be enough to see the country continue to post growth this year and next.

She said growth for 2009 was forecast at between 5% and 5.5%, and while some moderation might take place in the fourth quarter, the economy was projected to expand by between 3.5% and 4.5% in the final quarter of this year.

“Usually, activities in the fourth quarter tend to be stronger but we need to see consumption activity sustained during that period,” she told the media yesterday.

Bank Negara's Govenor Tan Sri Dr Zeti Akhtar Aziz during a media conference on economic and financial developments in Malaysia for the third quarter of 2008 at Bank Negara on Friday. She said that As global economic growth weakens significantly, Bank Negara believes Malaysia will not join the list of countries that have slipped into recession.

Bank Negara's Govenor Tan Sri Dr Zeti Akhtar Aziz during a media conference on economic and financial developments in Malaysia for the third quarter of 2008 at Bank Negara on Friday. She said that As global economic growth weakens significantly, Bank Negara believes Malaysia will not join the list of countries that have slipped into recession. In shooting down talk of Malaysia entering into a recession, Zeti said the reason for slower growth had been the external sector.

“Our financial institutions continue to function and lend and we have ample liquidity in our financial system,” she said.

The central bank governor said prices were moderating and the reversal should help investment activity which had been dampened by high costs.

Zeti said there were no large scale retrenchments in Malaysia and the position of households was still stable. “We are also an economy that does not have an asset bubble.

Zeti said there were no large scale retrenchments in Malaysia and the position of households was still stable. “We are also an economy that does not have an asset bubble.“All these elements enhance our prospects of sustaining growth even though it may be more a moderate growth. It certainly enhances our prospects and reduces the risk of a recession in our economy,” she said.

Should the situation deteriorate faster than predicted, the central bank and the Government have, at their disposal, fiscal and monetary measures to counter the situation.

“We are also monitoring the policies taken by crisis-affected countries and how effectively they will be implemented and their results,” she said.

Zeti said the central bank still had room for further adjustments on interest rates should the need arise but added that the current overnight policy rate was “very low and it is seen as very supportive of growth”.

“We do not see the applications for loans slowing significantly; therefore it has not been a factor inhibiting borrowing trends.”

Zeti said the cut in interest rates by countries such as China recently was to promote growth or to avoid a major economic downturn.

“The priority now is to avoid a major economic downturn because the cost of this will be very high,” she said.

“If we have a major economic downturn in any part of the world, it would involve the closure of businesses, defaults and rise in unemployment and all these will result in a prolonged recession.”

On inflation, Zeti said it had peaked at 8.4% and the rate was expected to moderate in the first half of 2009 before dropping more significantly in the second half of next year.

Source : The Star, by Jagdev Singh Sindhu

On inflation, Zeti said it had peaked at 8.4% and the rate was expected to moderate in the first half of 2009 before dropping more significantly in the second half of next year.

Source : The Star, by Jagdev Singh Sindhu

Achmade Zachary Ghazali,

http://dca2u.blogpsot.com

Tuesday, September 2, 2008

PM Funds' Returns

We Give You More Than ASB, ASN, ASW, Tabung Haji, KWSP and Fixed Deposit.

We Give You More Than You Can Ever Imagine.

Please Contact Me For An Appointment.

Thank you,

AZG,

Achmade Zachary Ghazali,

Email : achmade.zachary@yahoo.com

Mobile No : +6014.6464.264

Please click on the image for better view. TQ

Achmade Zachary Ghazali,

http://dca2u.blogspot.com

We Give You More Than You Can Ever Imagine.

Please Contact Me For An Appointment.

Thank you,

AZG,

Achmade Zachary Ghazali,

Email : achmade.zachary@yahoo.com

Mobile No : +6014.6464.264

Please click on the image for better view. TQ

Achmade Zachary Ghazali,

http://dca2u.blogspot.com

Malaysian Inflation Hits A New 26-year High in July

Fri, Aug 22, 2008

AFP

KUALA LUMPUR - MALAYSIAN'S inflation rate rose to a new 26-year high of 8.5 per cent in July, driven higher by the escalating cost of fuel and electricity, according to official data released on Friday.

The result was substantially higher than expected, and increased pressure on the central Bank Negara to raise official interest rates, said Wan Suhaimi Saidi, an economist with Kenanga Investment Bank.

'Definitely it is way above expectations. The consensus among economists was that inflation in July will hit 7.8 per cent,' he said. 'It is the highest since November 1981.'

'This gives the monetary authorities more reasons to push for a rate hike,' he added.

The Department of Statistics said that the cost of food and non-alcoholic drinks rose 11.2 per cent in July compared to a year ago - an outcome that illustrates the burden high inflation is putting on Malaysian consumers.

'Among the contributing factors for (July's inflation) were the substantial rise in the electricity tariff announced by the government... and the knock-on effect from the price increase of petrol and diesel,' it said in a statement.

The July data showed escalating prices in most categories, including transport which jumped 22.7 per cent, and restaurants and hotels which rose 6.7 per cent.

Malaysia's government hiked the fuel price by 41 per cent in June, in a move to rein in the ballooning cost of subsidies.

High inflation was one of the factors that led to an unprecedented humiliation at March general elections for the ruling coalition, which lost five states and a third of parliamentary seats.

Bank Negara has said it expects inflation to moderate in the second half of 2008 as economic growth is likely to slow down. -- AFP

Achmade Zachary Ghazali,

http://dca2u.blogspot.com

AFP

KUALA LUMPUR - MALAYSIAN'S inflation rate rose to a new 26-year high of 8.5 per cent in July, driven higher by the escalating cost of fuel and electricity, according to official data released on Friday.

The result was substantially higher than expected, and increased pressure on the central Bank Negara to raise official interest rates, said Wan Suhaimi Saidi, an economist with Kenanga Investment Bank.

'Definitely it is way above expectations. The consensus among economists was that inflation in July will hit 7.8 per cent,' he said. 'It is the highest since November 1981.'

'This gives the monetary authorities more reasons to push for a rate hike,' he added.

The Department of Statistics said that the cost of food and non-alcoholic drinks rose 11.2 per cent in July compared to a year ago - an outcome that illustrates the burden high inflation is putting on Malaysian consumers.

'Among the contributing factors for (July's inflation) were the substantial rise in the electricity tariff announced by the government... and the knock-on effect from the price increase of petrol and diesel,' it said in a statement.

The July data showed escalating prices in most categories, including transport which jumped 22.7 per cent, and restaurants and hotels which rose 6.7 per cent.

Malaysia's government hiked the fuel price by 41 per cent in June, in a move to rein in the ballooning cost of subsidies.

High inflation was one of the factors that led to an unprecedented humiliation at March general elections for the ruling coalition, which lost five states and a third of parliamentary seats.

Bank Negara has said it expects inflation to moderate in the second half of 2008 as economic growth is likely to slow down. -- AFP

Achmade Zachary Ghazali,

http://dca2u.blogspot.com

Inflasi berlanjutan 2009

ARKIB : 01/09/2008 / Utusan Malaysia

Inflasi berlanjutan 2009

Oleh DALIZA ARIFFIN

KUALA LUMPUR 31 Ogos - Bank Negara Malaysia (BNM) menjangkakan inflasi akan terus tinggi pada separuh kedua tahun ini dan berlanjutan hingga ke awal tahun depan.

Laporan perkembangan ekonomi dan kewangan di Malaysia pada suku kedua yang dikeluarkan bank pusat berkata, kadar kenaikan itu mungkin akan menjadi sederhana menjelang pertengahan tahun depan.

''Penstrukturan semula harga tenaga dalam negeri secara menyeluruh pada bulan Jun dijangka mempunyai kesan deflasi terhadap ekonomi pada separuh kedua tahun ini hingga ke awal tahun 2009,'' katanya.

Bank pusat dalam laporan tersebut menyatakan bahawa, Kadar Dasar Semalaman (OPR) pada suku kedua tidak berubah pada 3.50 peratus dan melaluinya kadar antara bank bagi semua tempoh matang secara relatif stabil dalam jangkamasa tersebut.

''Daripada segi kadar pinjaman, purata kadar pinjaman asas (BLR) tidak berubah pada suku kedua manakala purata kadar pinjaman (ALR) lebih rendah pada 6.08 peratus pada akhir bulan Jun.

''Kadar deposit pula secara relatif stabil dalam tempoh berkenaan,'' terangnya.

BNM mejelaskan bahawa sistem perbankan terus berdaya tahan dan berkedudukan kukuh untuk memenuhi keperluan pembiayaan serta perkhidmatan kewangan ekonomi dalam negeri.

Katanya, sistem perbankan telah mencatat keuntungan sebelum cukai sebanyak RM5.2 bilion pada suku kedua dengan purata pulangan atas aset serta ekuiti tahunan masing-masing pada 1.7 peratus dan 22 peratus.

Pinjaman tidak berbayar (NPL) bersih berdasarkan kepada klasifikasi tiga bulan menurun lagi sebanyak 6.7 peratus kepada RM17.8 bilion untuk mencakupi 2.7 peratus daripada jumlah bersih.

Selain itu, BNM dalam laporan tersebut memberitahu bahawa, aliran masuk kasar pelaburan asing telah meningkat kepada RM12.2 bilion yang mana ia disalurkan kepada sektor perkhidmatan, perkilangan, minyak dan gas.

Menurutnya, pada suku kedua, sentimen pelabur di Malaysia dan rantau Asia terjejas akibat kebimbangan terhadap kesan harga tenaga yang lebih tinggi dan kelembapan ekonomi Amerika Syarikat (AS) terhadap prospek pertumbuhan rantau ini.

Mengenai momentum pertumbuhan ekonomi, bank pusat berkata, ekonomi Malaysia yang mencatat pertumbuhan sebanyak 6.3 peratus pada suku kedua dijangka terjejas ekoran perkembangan daripada persekitaran global.

''Kesan kenaikan harga, kos komoditi dan bahan api akan terus memberikan deflasi terhadap permintaan dalam negeri selain mempengaruhi sentimen pengguna dan perniagaan.

''Walaupun terdapat tanda-tanda pertumbuhan semakin sederhana, dengan asas ekonomi yang teguh dan sektor perbankan yang berdaya tahan, ekonomi Malaysia berpotensi untuk terus mencatat pertumbuhan yang kukuh,'' katanya.

Achmade Zachary Ghazali,

http://dca2u.blogspot.com

Inflasi berlanjutan 2009

Oleh DALIZA ARIFFIN

KUALA LUMPUR 31 Ogos - Bank Negara Malaysia (BNM) menjangkakan inflasi akan terus tinggi pada separuh kedua tahun ini dan berlanjutan hingga ke awal tahun depan.

Laporan perkembangan ekonomi dan kewangan di Malaysia pada suku kedua yang dikeluarkan bank pusat berkata, kadar kenaikan itu mungkin akan menjadi sederhana menjelang pertengahan tahun depan.

''Penstrukturan semula harga tenaga dalam negeri secara menyeluruh pada bulan Jun dijangka mempunyai kesan deflasi terhadap ekonomi pada separuh kedua tahun ini hingga ke awal tahun 2009,'' katanya.

Bank pusat dalam laporan tersebut menyatakan bahawa, Kadar Dasar Semalaman (OPR) pada suku kedua tidak berubah pada 3.50 peratus dan melaluinya kadar antara bank bagi semua tempoh matang secara relatif stabil dalam jangkamasa tersebut.

''Daripada segi kadar pinjaman, purata kadar pinjaman asas (BLR) tidak berubah pada suku kedua manakala purata kadar pinjaman (ALR) lebih rendah pada 6.08 peratus pada akhir bulan Jun.

''Kadar deposit pula secara relatif stabil dalam tempoh berkenaan,'' terangnya.

BNM mejelaskan bahawa sistem perbankan terus berdaya tahan dan berkedudukan kukuh untuk memenuhi keperluan pembiayaan serta perkhidmatan kewangan ekonomi dalam negeri.

Katanya, sistem perbankan telah mencatat keuntungan sebelum cukai sebanyak RM5.2 bilion pada suku kedua dengan purata pulangan atas aset serta ekuiti tahunan masing-masing pada 1.7 peratus dan 22 peratus.

Pinjaman tidak berbayar (NPL) bersih berdasarkan kepada klasifikasi tiga bulan menurun lagi sebanyak 6.7 peratus kepada RM17.8 bilion untuk mencakupi 2.7 peratus daripada jumlah bersih.

Selain itu, BNM dalam laporan tersebut memberitahu bahawa, aliran masuk kasar pelaburan asing telah meningkat kepada RM12.2 bilion yang mana ia disalurkan kepada sektor perkhidmatan, perkilangan, minyak dan gas.

Menurutnya, pada suku kedua, sentimen pelabur di Malaysia dan rantau Asia terjejas akibat kebimbangan terhadap kesan harga tenaga yang lebih tinggi dan kelembapan ekonomi Amerika Syarikat (AS) terhadap prospek pertumbuhan rantau ini.

Mengenai momentum pertumbuhan ekonomi, bank pusat berkata, ekonomi Malaysia yang mencatat pertumbuhan sebanyak 6.3 peratus pada suku kedua dijangka terjejas ekoran perkembangan daripada persekitaran global.

''Kesan kenaikan harga, kos komoditi dan bahan api akan terus memberikan deflasi terhadap permintaan dalam negeri selain mempengaruhi sentimen pengguna dan perniagaan.

''Walaupun terdapat tanda-tanda pertumbuhan semakin sederhana, dengan asas ekonomi yang teguh dan sektor perbankan yang berdaya tahan, ekonomi Malaysia berpotensi untuk terus mencatat pertumbuhan yang kukuh,'' katanya.

Achmade Zachary Ghazali,

http://dca2u.blogspot.com

Wednesday, August 6, 2008

5 Strategies for Surviving Tough Times

5 Strategies for Surviving Tough Times

When economic times turn tough, governments urge their citizens to spend. Economists think of citizens as "consumers" and rely on them to put their "disposable income" to work. By doing this they will support the economy, which translates into higher stock prices. However, in times like early 2008, when consumers were reeling from the perfect storm of inflation, a global credit crunch, a global housing market in decline and concerns about stagflation, there is often a conflict with the governmental cry for consumers to spend. It's a bewildering scenario. What's the best course of action for a concerned consumer to take? The following strategies provide a road map for surviving economic downturns.

1. Don't Buy What You Can't Afford

We all want that designer sweater, leather handbag, or cute sports car, but most of us just can't afford to make the purchases. There's a simple solution to this dilemma. If you can't afford it, don't buy it. This is often the easiest point to understand, but it is one of the hardest to implement when all those goodies are staring you in the face and all your credit companies are

telling you it's OK.

2. If You Can't Pay Cash, You Probably Can't Afford It

In our credit crazy world, amassing debt no longer carries a social stigma. Everybody has a car payment, a house payment and credit card payments. Well, remember what your mother said about everybody jumping off of a bridge? Just because "everybody" is doing it, doesn't make it a good idea. Buying something you can't afford now, especially when the economy is unsettled, can double the pain of paying later. For example, if you purchase a $450,000 home today and the market goes into a slump and devalues your home by $200,000, you will be paying the bank twice what the home has come to be worth. Just because it was easy to get the credit to buy

that home, doesn't mean it was the right time for you to buy in.

3. Paying Interest on Anything Makes Somebody Else Rich

When you pay interest on a purchase, you are overpaying for that item for the luxury of getting to use it now. The simple act of paying interest means that the price you are paying to make the purchase is greater than the sale price of the item. You are giving away even more of your hardearned money in order to own that item than the manufacturer thought the item was worth. For example, if you buy a car for $25,000 with a loan at 7% interest for five years, in the end, you will pay almost $30,000 for the car. Once you factor in depreciation, you're left with a very cheap car that cost you thousands more than it should have.

4. If You Are in Debt, stop Spending Money

Sometimes, such as when purchasing a home, the cost of the item is so great that you simply cannot afford to pay cash. This should be the exception rather than the rule. When it cannot be avoided, you need to close your purse and stop spending. Getting yourself further it debt doesn't help your financial situation. Making a realistic budget in this case is the key to success. Once you know how much you're actually spending on those daily trips to the grocery store and coffee shop, you'll be able to find room to cut costs realistically.

5. Don't Count on Somebody Else to Save You

In times of economic uncertainty, people often think the government will be able to help them, but unfortunately this is often the time when the government has the least amount of money and freedom to help its own citizens. In most cases, the government won't save you, so you'll have to save yourself. When the economy is in a downturn, you can't just look at what you are spending, you also need to look at where the money is coming from. Your employer is facing the same difficulties you are: trying to make bill payments, balancing the flow of capital, all while sales are

slowing. Just like you, your employer will be looking to reduce its costs, which could be in the form of layoffs. You could be in big trouble if you haven't planned for this possibility. The plan here is to start saving now for that eventual rainy day, and prepare an emergency fund for yourself. If it is too late to start saving and you already need the money, many financial institutions will let you defer a payment or two if you prove you have a smart financial plan to eventually pull through. When People Don't Spend

But wait! If we're all hanging on to our money rather than feeding the economy, what will happen? Will stock prices plummet? Will economic growth grind to a halt? Will we all be poor? No. For a real world example of this, let's take a look at Japan, where saving more than consuming has been commonplace in its people's history.

While being a net lender is a concept that the West abandoned some time after World War II, it continued to be practiced in Japan. During the mid-1970s, Reuters reports that Japanese consumers saved some 20% of their disposable incomes. During Japan's economic slump in the 1990s, the Nikkei 225 fell from a peak of 39,000 in 1989 to 16,000 in 1992. Gross domestic product growth averaged less than 1% per year, but personal savings remained in the double digits. Although the unemployment rate rose from less than 2.5% in 1990 to just under 5% in 2000, with an average of 3% percent according to the U.S. Department of Labor, it still remained lower than the rate in most industrialized nations. The net result? Japan remained a healthy,

vibrant, wealthy country with a poorly performing stock market. If you've got savings and a smart financial plan, a weak market won't break you.

Live Now Like You Face Tough Times These five strategies work equally well when times are good, so there is no need to wait until you are in trouble to start making smart decisions.Your lifestyle will be characterized by things you can actually afford, such as a house that won't get repossessed, a car that might not impress

the neighbors but will still get you to work and back, and long, restful nights free from financial worries. It might not be the fairytale lifestyle of the rich and famous that corporate marketers having been trying sell you, but at least you won't have to worry about how to keep up on the payments for a lifestyle you can't afford.

by Lisa Smith

Thursday, May 22, 2008

provided by investopedia.com

Achmade Zachary Ghazali,

http://dca2u.blogspot.com

When economic times turn tough, governments urge their citizens to spend. Economists think of citizens as "consumers" and rely on them to put their "disposable income" to work. By doing this they will support the economy, which translates into higher stock prices. However, in times like early 2008, when consumers were reeling from the perfect storm of inflation, a global credit crunch, a global housing market in decline and concerns about stagflation, there is often a conflict with the governmental cry for consumers to spend. It's a bewildering scenario. What's the best course of action for a concerned consumer to take? The following strategies provide a road map for surviving economic downturns.

1. Don't Buy What You Can't Afford

We all want that designer sweater, leather handbag, or cute sports car, but most of us just can't afford to make the purchases. There's a simple solution to this dilemma. If you can't afford it, don't buy it. This is often the easiest point to understand, but it is one of the hardest to implement when all those goodies are staring you in the face and all your credit companies are

telling you it's OK.

2. If You Can't Pay Cash, You Probably Can't Afford It

In our credit crazy world, amassing debt no longer carries a social stigma. Everybody has a car payment, a house payment and credit card payments. Well, remember what your mother said about everybody jumping off of a bridge? Just because "everybody" is doing it, doesn't make it a good idea. Buying something you can't afford now, especially when the economy is unsettled, can double the pain of paying later. For example, if you purchase a $450,000 home today and the market goes into a slump and devalues your home by $200,000, you will be paying the bank twice what the home has come to be worth. Just because it was easy to get the credit to buy

that home, doesn't mean it was the right time for you to buy in.

3. Paying Interest on Anything Makes Somebody Else Rich

When you pay interest on a purchase, you are overpaying for that item for the luxury of getting to use it now. The simple act of paying interest means that the price you are paying to make the purchase is greater than the sale price of the item. You are giving away even more of your hardearned money in order to own that item than the manufacturer thought the item was worth. For example, if you buy a car for $25,000 with a loan at 7% interest for five years, in the end, you will pay almost $30,000 for the car. Once you factor in depreciation, you're left with a very cheap car that cost you thousands more than it should have.

4. If You Are in Debt, stop Spending Money

Sometimes, such as when purchasing a home, the cost of the item is so great that you simply cannot afford to pay cash. This should be the exception rather than the rule. When it cannot be avoided, you need to close your purse and stop spending. Getting yourself further it debt doesn't help your financial situation. Making a realistic budget in this case is the key to success. Once you know how much you're actually spending on those daily trips to the grocery store and coffee shop, you'll be able to find room to cut costs realistically.

5. Don't Count on Somebody Else to Save You

In times of economic uncertainty, people often think the government will be able to help them, but unfortunately this is often the time when the government has the least amount of money and freedom to help its own citizens. In most cases, the government won't save you, so you'll have to save yourself. When the economy is in a downturn, you can't just look at what you are spending, you also need to look at where the money is coming from. Your employer is facing the same difficulties you are: trying to make bill payments, balancing the flow of capital, all while sales are

slowing. Just like you, your employer will be looking to reduce its costs, which could be in the form of layoffs. You could be in big trouble if you haven't planned for this possibility. The plan here is to start saving now for that eventual rainy day, and prepare an emergency fund for yourself. If it is too late to start saving and you already need the money, many financial institutions will let you defer a payment or two if you prove you have a smart financial plan to eventually pull through. When People Don't Spend

But wait! If we're all hanging on to our money rather than feeding the economy, what will happen? Will stock prices plummet? Will economic growth grind to a halt? Will we all be poor? No. For a real world example of this, let's take a look at Japan, where saving more than consuming has been commonplace in its people's history.

While being a net lender is a concept that the West abandoned some time after World War II, it continued to be practiced in Japan. During the mid-1970s, Reuters reports that Japanese consumers saved some 20% of their disposable incomes. During Japan's economic slump in the 1990s, the Nikkei 225 fell from a peak of 39,000 in 1989 to 16,000 in 1992. Gross domestic product growth averaged less than 1% per year, but personal savings remained in the double digits. Although the unemployment rate rose from less than 2.5% in 1990 to just under 5% in 2000, with an average of 3% percent according to the U.S. Department of Labor, it still remained lower than the rate in most industrialized nations. The net result? Japan remained a healthy,

vibrant, wealthy country with a poorly performing stock market. If you've got savings and a smart financial plan, a weak market won't break you.

Live Now Like You Face Tough Times These five strategies work equally well when times are good, so there is no need to wait until you are in trouble to start making smart decisions.Your lifestyle will be characterized by things you can actually afford, such as a house that won't get repossessed, a car that might not impress

the neighbors but will still get you to work and back, and long, restful nights free from financial worries. It might not be the fairytale lifestyle of the rich and famous that corporate marketers having been trying sell you, but at least you won't have to worry about how to keep up on the payments for a lifestyle you can't afford.

by Lisa Smith

Thursday, May 22, 2008

provided by investopedia.com

Achmade Zachary Ghazali,

http://dca2u.blogspot.com

Tuesday, May 6, 2008

Financial Planning - Christian Biblical Perspective

"For where your treasure is, there your heart will be also." Matthew 6:21 (NIV)

God has a plan for your life and your finances as well. Let's review a few important considerations that you will need to take into account in order to implement God's financial plan for your life.

The Right Foundation

The first important aspect of financial planning to consider is your purpose. Your purpose in life and the purposes that God calls your family to will have a great impact on the way you manage the resources God has given you.

If you understand your life's purpose first, you will become more effective in your day-to-day living and clearer about the financial decisions you need to make. Great examples of individuals who understood their purpose are William Wilberforce, who sought to abolish slavery in England, and Martin Luther in the Reformation. Both men lived with purpose and were amazingly effective as a result of this knowledge.

Where else can we see the effects of understanding one's purpose? We see it most clearly in the intentionality with which God directs our lives. God intentionally declares His holiness and does so with relentlessness as He interacts with us. God knows the plans He has for us and He is driven by this holy purpose. Think about the implications that this has for your life. God is seeking to reveal His holiness through you and He will not quit that purpose. What a great example God has given us of the focus we need to have.

How does this relate to investing and financial planning? Well, just as He did with Wilberforce and Luther, God has a plan for your life. You can be confident in this fact, and know that He will give you the necessary resources to accomplish His purposes. All you need to do is ask Him.

The fact that God has a plan for you also means that you need to be clear in understanding the gifts and resources that God has given your family and how you can work together to serve Himi. This understanding should direct where you give, where you invest your time and money, and how you view the world. Spend time thinking, praying, and journaling about this aspect of your life before you dig into the practical aspects of developing a financial plan.