Founder of Dinar Consultants.

“We are more than a service. We are a resource for our clients. They rely upon us to address their investments because of our depth of expertise as well as our national network of contacts in the corporate, entrepreneurial, and public sectors”.

Dinar Consultants

In December 2005, Dinar Consultants was founded by a young potential entrepreneur, Achmade Zakry Ghazali, to provide high quality cutting edge Unit Trust Investment superb service for its valued clients and continuous training for its unit trust consultants. Dinar Consultants is a direct agency under the management of an award-winning agency, Sterling Consultants Agency.

In both the Islamic funds and Conventional funds marketplaces, Dinar Consultants Agency is a respected resource for personal investors, corporate companies or even other financial consultants who seek our expertise. With Dinar Consultants as your unit trust consultant, you can conduct your unit trust transactions with confidence knowing your investment will be monitored regularly. We founded Dinar Consultants Agency to transform our knowledge into value for our clients. It is very satisfying to earn their trust, transaction after transaction.

Literal Meaning of Dinar

Dinar means gold or money, a unit of money widely used in Muslim countries.

Technical Meaning of Dinar

Dinar is a combination of two words, Deen ( Religion ) and Nar ( Hell ). It can be interpreted as money is good only if we use it for the good deeds. On the contrary, if we use money for the evil purpose, we’ll be burnt in the Hell. ( Nauzubillahi min zhaliq )

“...And there are those who bury gold and silver and

spend it not in the way of Allah: announce unto them a most

grievous penalty. On the Day, when it will (all) be heated in

the fire of Hell, and with it will be branded their foreheads,

their flanks, and their backs. (and it will be said unto them) :

This is the (treasure) which you buried for yourselves: taste

you, then, the treasures you buried”

( Surat at-Tawba : 34-35 )

Our Services

Individual & Corporate Unit Trust Investment

EPF ( KWSP ) Investment Scheme

Islamic & Conventional Investment

Retirement Planning or Children Education

Our Roles

· To create awareness among people about the importance of financial planning, encourage them to save their hard-earned money and invest wisely.

· To help clients analyse their financial situation, establish their investment goals and propose an investment plan.

· To continuously monitor and rebalance clients’ portfolio(s) to check on their investments' potential returns.

· To build a trusted relationship with clients by providing ethical and professional advisory services.

· To continuously upgrade skills and knowledge with the aspiration of being a ‘value-creating’ consultant.

Our Vision

We are a service-oriented team of diverse unit trust well-trained consultants, backed by the No.1 Unit Trust Company in Malaysia. It is our vision to meet and exceed our clients' expectations. We achieve this vision by combining our industry insight and unsurpassed technical expertise with faithful service - confident that, by doing so, we are enhancing the value of unit trust investments in a free economy.

Our Mission

As an agency of the No.1 Unit Trust Company in Malaysia, Dinar Consultants Agency adheres to and promotes "the standards of excellence" espoused by the Company.

Sterling Consultants

Meanwhile, Sterling Consultants was founded in 2004 by well trained leader, MFGAM Adi Sasteria Nurputra. Under his great leadership and strong supports from other team members, Sterling Consultants is one of the top agencies in The No.1 Unit Trust Company in Malaysia. It has been awarded for its strong performance by the Company since 2005.

Sterling Consultants is backed by its excellent networking agencies, such as Sterling Consultants 2 led by MFGAM Amylia Shariza, NetWorth Consultants led by MFGAM Mohd Amin Yahya, Atrium Consultants led by MFGAM Hismazatul, GrowRich Consultants led by MFGAM Iskandar Zulkarnain, Titan Consultants led by MFAM Md Shah Muhaimin, MaxWealth Consultants led by MFAM Amri, Prodigy Consultants led by MFAM Sherry Arizal, Millionaire Warriors led by MFAM Mimi Mior, MFAM Hisham & MFAM Siti Uraidah, KAK Consultants led by MFAM Khairil Annuar Abd Kadir and last but not least Dinar Consultants Agency (DCA) led by MFAM Achmade Zachary Ghazali etc.

Sterling Consultants’ Credentials

Nationwide Achievements

2009 Awards

Champion Group Agency Manager 2009

Champion Mutual Fund Manager 2009

1st Runner-up Mutual Fund Manager 2009

Champion Mutual Fund Supervisor 2009

1st Runner-up Mutual Fund Supervisor 2009

Champion Mutual Fund Consultant 2009

Million-Dollar Producer 2009

2008 Awards

1st Runner-up Group Agency Manager 2008

1st Runner-up Mutual Fund Manager 2008

2nd Runner-up Mutual Fund Manager 2008 2nd Runner-up Mutual Fund Supervisor 2008

Top 6 & 14 Personal Sales Producer 2008

Million-Dollar Producers 2008

Champion Agency Manager 2007

Champion Mutual Fund Agent 2007

1st Runner-up Mutual Fund Supervisor 2007

2nd Runner-up Mutual Fund Supervisor 2007

Top 4 & 10 Personal Sales Producer 2007

Million-Dollar Producer 2007

2006 Awards

Champion Mutual Fund Supervisor 2006

2nd Runner-up Agency Manager 2006

No 6 Personal Sales Producer 2006

Top New EPF Sales Award 2006

Million-Dollar Producer 2006

2005 Awards

Top Mutual Fund Agent 2005

Million Dollar Producer 2005

Achmade Zakry Ghazali,

http://dca2u.blogspot.com

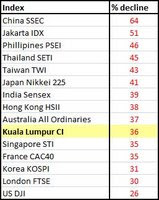

Average Weekly Range % (Volatility) of KLCI since 1994In Malaysia, the year started with a very bullish sentiment accumulated from a six years bullish trend that started in year 2002 after the dotcom bubble burst in the year 2000. The Kuala Lumpur Composite Index was at about 600 points. The momentum starts to get very bullish in the mid year 2006, when the KLCI was at about 900 points and one year later, it created a new record high. On April 2007, I wrote in Smart Investor and forecasted the KLCI to go as high as 1,500 points. In January 2008, the KLCI closed the highest level ever at 1,516.22 points.

Average Weekly Range % (Volatility) of KLCI since 1994In Malaysia, the year started with a very bullish sentiment accumulated from a six years bullish trend that started in year 2002 after the dotcom bubble burst in the year 2000. The Kuala Lumpur Composite Index was at about 600 points. The momentum starts to get very bullish in the mid year 2006, when the KLCI was at about 900 points and one year later, it created a new record high. On April 2007, I wrote in Smart Investor and forecasted the KLCI to go as high as 1,500 points. In January 2008, the KLCI closed the highest level ever at 1,516.22 points.